.jpg?width=360&height=238&ext=.jpg)

Lessees and lessors alike could benefit from tax savings opportunities introduced to mitigate the economic impacts of COVID-19.

The pandemic has increased capital expenditures for many property types, including office, restaurant, and retail. Some owners and lessors were forced to do so in order to meet social distancing requirements, while others have utilized the shutdown time to perform long-awaited large-scale renovations. Whatever the case may be, significant tax benefits could be available.

Below, we talk about key opportunities brought forth by the Coronavirus Aid, Relief, and Economic Security (CARES) Act and related property renovation strategies for lessees and lessors.

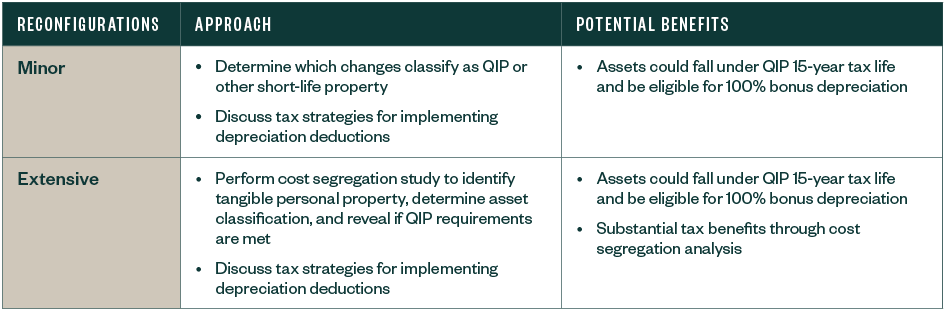

Property Reconfiguration Benefits

Businesses of all types are continuing to adapt their facilities to meet COVID-19 requirements, protect their customers, and provide employees with safe working environments. While tax benefits are available for many of these changes, they differ based on the size and scope of an entity’s renovations.

Minor Reconfigurations

Some open-air office spaces have been reverted to single-use offices and cubicles, while retail and restaurant spaces have added partitions and other free-standing modules.

The capital expenditures incurred to make these reconfigurations come at an inopportune time; margins for most businesses are slimmer than they have been in recent years. For these businesses, the CARES Act is a much-needed lifeline for many reasons—one of those being the technical correction to Qualified Improvement Property (QIP).

QIP Technical Correction

The QIP technical correction allows assets such as added partitions, demising walls, and other resources that fall under the QIP definition to have a 15-year tax life. More importantly, these assets are generally eligible for 100% bonus depreciation, otherwise known as immediate or full expensing. Learn more about QIP and bonus depreciation in our article.

Lessees and lessors that perform minimal configurations to their facility space will likely find that the bulk, if not all, of the improvements will fall under this definition. They may receive significant tax deductions as a result. To learn more about eligibility and next steps, read our article.

Significant Renovations

With customers staying home more than ever, many lessors and lessees are using this time to perform substantial remodels, renovations, and additions to their properties.

Due to a lack of resources and understanding of the capitalization rules, taxpayers often capitalize these expenditures as one asset on their depreciation schedule, either as nonresidential real property or as QIP. Classifying the entire amount as 39-year nonresidential real property would be understating the depreciation amount, resulting in taxpayers missing out on potentially significant tax benefits. However, classifying the entire amount as QIP may understate income by including assets that don’t fit the QIP definition, which could increase exposure.

Example

If a taxpayer’s remodel scope includes a new HVAC system, the ductwork would fit the QIP category, but the exterior HVAC unit wouldn’t. A building’s storefront is another example of a commonly renovated area in a retail facility that is unlikely to meet the QIP definition.

Another example would be if an improvement is a partial remodel and partial expansion; the remodel could fit the QIP definition, but the expansion wouldn’t.

Cost Segregation Analysis

For projects of a significant size, a cost segregation analysis can serve as a good way to determine which improvements qualify for accelerated recovery.

Cost segregation is an engineering-based tax study that involves breaking down real property into short-life assets. Traditionally, the main goal of the study is to identify tangible personal property, typically recovered over five or seven years, by reviewing cost detail, construction drawings, and conducting a site inspection.

These same techniques can be used to break out additional building-cost components that are eligible for QIP, including:

- Interior versus exterior renovations

- Structural versus nonstructural changes

- Expanded versus existing property

Cost segregation can also identify short-life property, which is beneficial for businesses that reside in states that don’t recognize bonus depreciation.

A study may increase a taxpayer’s accounting bill in the year it’s performed, but most times the analysis itself will save the taxpayer much more than it costs in increased depreciation deductions in the initial years of the asset’s life. Before engaging in a study, a taxpayer can determine potential savings by receiving an estimate of benefits from a tax professional.

.png?width=945&height=311&ext=.png)

Claiming Depreciation Deductions

Complexities around claiming accelerated depreciation deductions often align with the size of an entity’s reconfigurations. For entities with minimal reconfiguration work, the consulting process may be as simple as confirming the new assets meet the eligibility criteria for QIP and applying the increased current deductions to reduce taxes owed.

Taxpayers that performed significant renovations or additions in a prior tax year may benefit from filing a Form 3115 method change with the IRS to retroactively change prior depreciation methods and catch up depreciation amounts to the current tax year. A method change could apply to multiple assets and may also be paired with a cost segregation study for larger assets.

That said, these taxpayers might also qualify for additional relief opportunities under other CARES Act tax provisions—including restored net operating losses (NOL) carryback provisions and the business interest deduction limitation. Learn more about these opportunities and how to claim them in our article.

We’re Here to Help

If your entity qualifies for accelerated depreciation deductions or other tax opportunities, it could benefit from working with a consulting professional to implement them.

We’re here to help your business determine and claim available tax opportunities during these difficult times. To learn how your business could benefit from existing provisions, or for assistance claiming tax benefits on your reconfigured space, contact read our article or contact your Moss Adams professional.